Opinion: Opinion: Buying gifts? Why buy now, pay later could be a dangerous option

Table of Content

The first step is to figure out where your credit score lands. Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. One is that they can cause consumers to become overextended and spend more than they can fundamentally afford. One reason is the ease of signing up for these loans, which may take only a few clicks.

Attempt to improve your overall financial situation as much as possible to improve your odds of getting approved for a conventional loan. Try to improve your credit score as much as possible before shopping. Because, after 90 days of non-payment, your lender has a legal right to reclaim your home, through a process known as foreclosure, which can be extremely costly to the bank. A credit score is a number used to predict the likelihood of a person going delinquent on a loan. That doesn't mean that a lower score leaves you on the sidelines, though.

HOMESTAR Blog

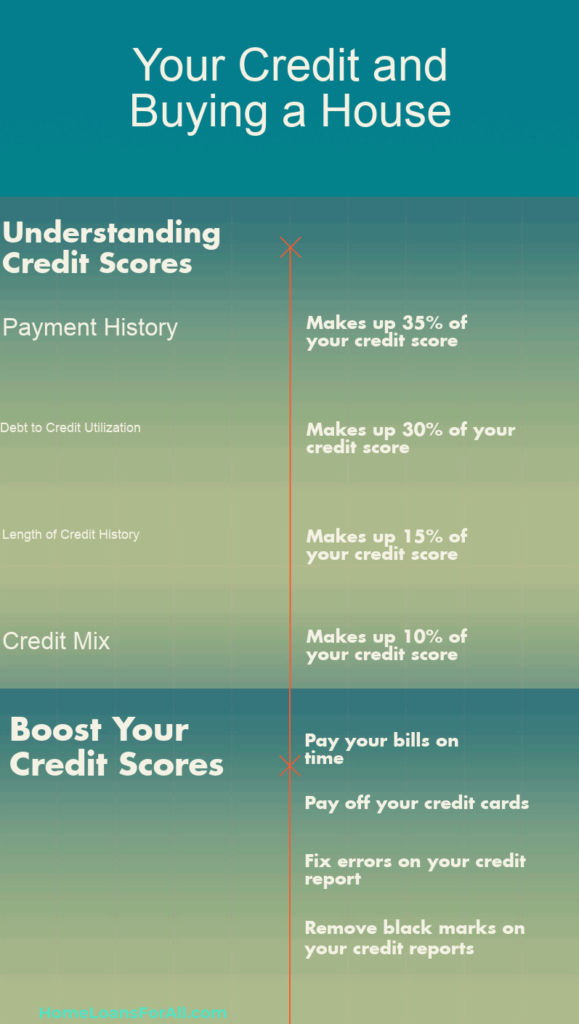

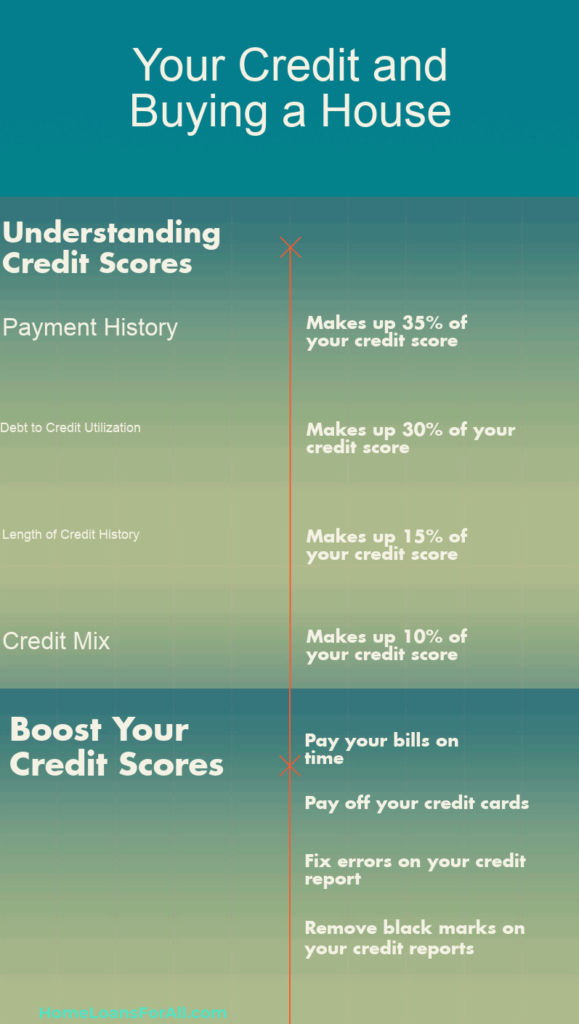

While this will lead to hard inquiries, they won’t stay on your credit report forever. Newer credit accounts harm the average age, and it also means that a hard inquiry has been made on your credit report. Any less than 6 months old credit is likely to be considered new credit, which can account for 10% of your score. If you have a better understanding of how credit scores are calculated, you should find improvements you can make to your own situation. Though if you have gone through bankruptcy, it doesn’t matter what your credit score is.

Credit reporting errors can affect your score by more than 100 points. The FHFA backs 81 percent of all U.S. mortgages, so your mortgage will probably be backed by the FHFA, too. Each post is edited and fact-checked by industry experts to ensure that we are providing accurate information for our readers.

Make your payments on time

It requires home buyers to have a minimum credit score of 580 at the time of purchase. Mortgage lenders look at the “age,” dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Just changing one of these components of your spending behavior can positively affect your credit score. This means people without any credit history, such as teenagers or new immigrants, may be able to take advantage of these plans. It also means people who have maxed out their credit cards can also participate.About three-quarters of all applicants are approvedalmost immediately.

A score of 620 may be enough to land a conventional loan, especially if you have a high income or offer a down payment of 10% or more. If you're approved for a conventional mortgage with a fair credit score, you may end up with a higher interest rate than is currently advertised. Lenders look favorably on high credit scores because they indicate that you've done an excellent job managing credit in the past. Borrowers with high scores are offered the lowest interest rates and have the easiest time landing loans when they need them. If you don’t qualify for any government-backed programs, you can still get a conventional loan with bad credit. The FHA loan program is one of the most popular among first-time homebuyers.

Explore more mortgage articles

Defaulting on your mortgage can lead to foreclosure and challenges if you ever try to apply for another FHA loan or conventional loan down the road. See how to buy a house with bad credit including getting a mortgage when you have a low credit score. If you have a collection on your credit report, lenders aren’t going to be convinced you’ll be a reliable borrower. The collection shows you haven’t paid back the money you owe and haven’t attempted to deal with the debt.

Get pre-approved with Homebuyer.com to check your credit report. So, whether your timeline to buy a home is six weeks, six months, or longer, you can improve your credit in time. Learn more about how to fix your credit score to buy a house. Home buyer assistance programs rarely enforce credit score minimums. Instead, they adopt the standards of their accompanying mortgage.

Check Your Credit Score First

Lenders can use an alternative payment history to approve VA loans. Unlike FHA loans, there are no down payment requirements, and you may not have to pay a higher interest rate. Of course, the best option is to work on repairing your credit score before you submit a mortgage application. While this is not the answer borrowers want to read or hear, it’s the most practical and can save you thousands in interest payments.

Only the home seller pays agent fees, so working with an agent costs you nothing. Explain your situation to a good agent and have them search out available homes with owner financing. You may be able to find out what your credit score is from your bank, credit union, or credit card company. You can also pay to find your credit score through a credit score service or look it up using a free credit scoring site. A non-bank entity may offer credit, real estate services, or act as a go-between for transmitting money. They may act like a lender in a variety of ways, but do not function as a bank.

Let us help you get to a 580 score, then 620, then even higher to maximize your mortgage options. Currently, conventional loans require home buyers to carry a 620 minimum credit score and make a minimum down payment of three percent. One way to make up for your thin credit file could be to ask a friend or family member with strong credit to cosign with you. Lenders factor that person's credit score into their decision. Remember, if you ever miss a mortgage payment, your mortgage cosigner is on the hook for it.

For instance, you’ll likely need to make a larger down payment — at least 5% or 10% down. The home you’re buying has to be a single-family property you’ll use as your primary residence. To verify rental history, the lender will request a ‘VOR’ or verification of rent from your current landlord.

All of this should have given you a better idea of how to get a mortgage with bad credit. While it can seem like an uphill struggle to buy a home if you have problems with your credit, you do have options. To avoid this problem, you can ask to have the collection removed from the report when you pay the debt. This should remove all traces of the problem and so won’t affect a lender’s decision.

Buying a home with bad credit is possible, whether you get a conventional loan or a government-backed loan through the FHA, USDA or VA. Getting a mortgage with bad credit is possible, but raising your credit score helps you access larger mortgage loans with lower rates. You’ll have more overall options if you raise your credit score before you buy a home. Like "regular" credit cards, most secured credit cards report your payments to the credit bureaus, helping to build your credit score.

Here are some government-backed loan options if you have poor credit. A copy of your credit report – the lender will require a credit check and report. Since you have a low credit score, you’ll probably need to fit into a custom-tailored mortgage program to your needs. Having a good credit score will help you get a lower interest rate on a mortgage, access to better financing options, and avoid being denied altogether. If you have a lower credit score because you’ve consistently mismanaged debts in the past, a lender will be much less likely to approve you for a mortgage. Taking on new debt could limit your loan options in another way, too.

Comments

Post a Comment