Can I Buy a House with Bad Credit?

Table of Content

What might prevent you from getting the mortgage you need with one lender might not be such an issue for another. It will be essential to shop around, and you may want to include local credit unions in your search. When you are looking to choose a lender, you have to remember that they don’t all have the same requirements. If you have a low amount of debt or no debt at all, this will help. If you can afford to pay a higher down payment, that will make a big difference.

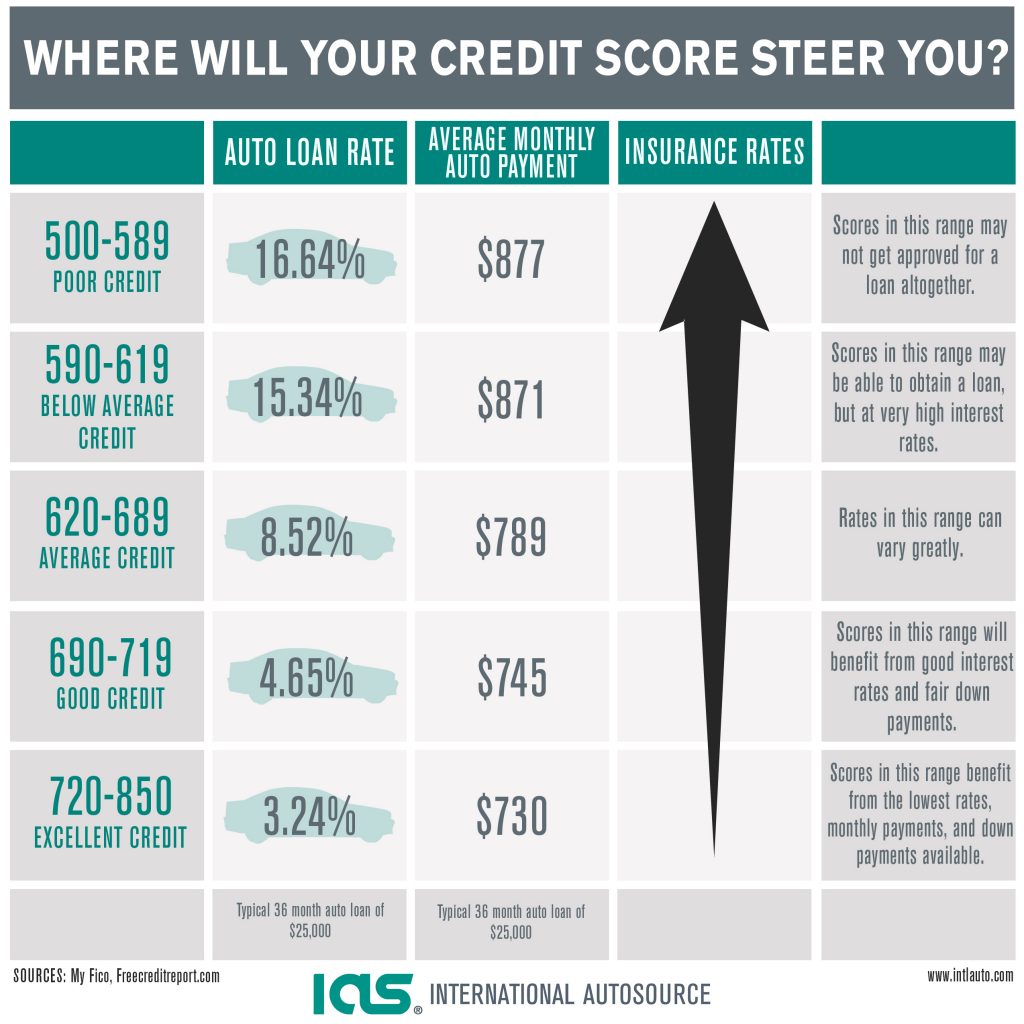

Prospective borrowers should run the math to see how much improving their credit and having more money to put down could save them before rushing into the homebuying process. You may qualify for a conventional loan, which isn't backed by a government agency like the FHA or VA, with a minimum credit score of 620. For example, the FHA loan, which is backed by the Federal Housing Administration , allows for a downpayment of just 3.5% for borrowers whose credit scores are 580 or higher. Owner-financed homes are not always easy to find, especially when the housing market is hot. While buying a home can be an emotional experience, taking out a mortgage is straight-up business. When a mortgage lender tells you that your credit score isn't high enough to qualify for a mortgage, it's nothing personal.

Establish an alternative payment history

And though she finds the color orange unflattering on most people, she thinks they'll enjoy Champaign tremendously. The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit you’re using, the higher your credit utilization, the lower your score can become.

In addition to being recognized as one of the best real estate blogs, Kyle has been recognized as one of the top Realtors on social media by several organizations and websites. Sign up for a credit improvement service such as Credit Karma or Credit Sesame. Both are excellent companies that can speed up improving your credit standing.

Why You Should Improve Your Credit Score Before Buying

When you begin the journey to homeownership, there’s a lot to think about. The most important one being which loan program is right for you – especially with so many options available. A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender.

Lenders can use an alternative payment history to approve VA loans. Unlike FHA loans, there are no down payment requirements, and you may not have to pay a higher interest rate. Of course, the best option is to work on repairing your credit score before you submit a mortgage application. While this is not the answer borrowers want to read or hear, it’s the most practical and can save you thousands in interest payments.

Good loan programs for buyers with bad credit

You can speak with a mortgage broker to get an idea of what to expect from certain lenders before submitting a mortgage application. Getting approved for a mortgage with no money down can be a little challenging. Below is a list of programs that allow you to buy a home with little to no money down and bad credit. For many, the home you purchase will be one of the biggest investments you’ll ever make.

All you need to do is make sure you make all payments on time and pay off your other debts. After you have increased your credit score, you may have the opportunity to refinance your home and obtain a lower interest rate and payment. First-time home buyers tend to have lower credit scores than the general population, and that’s okay. There are plenty of mortgage programs meant to help first-time buyers move into homeownership. There’s a large selection of mortgage loans geared toward first-time home buyers, and which allow for lower credit scores.

If you're a veteran or current armed forces member, VA loans were made especially for you. Backed by the Department of Veterans Affairs, a VA loan not only offers 0% down mortgages, but the score needed to qualify varies by lender. For example, Rocket Mortgage approves VA loans with scores as low as 580. Owning a house comes with plenty of financial responsibility, but it's also rewarding!

If you're interested in buying a home in a qualifying rural area with no down payment, a USDA loan makes it possible with a score in the 640 range. FHA home loans are backed by the Federal Housing Administration and typically require a credit score of around 580. However, if you can make a 10% down payment, you may be approved with a score as low as 500. About 90% of these loans are tied to a debit card, which means the payments are automatically deducted from the borrower’s bank account. So when someone misses a payment, it’s likely because there were insufficient funds in their account. Besides the late fee, these borrowers will also end up getting charged an overdraft fee.

The FHA mortgage is available to first-time home buyers with ‘thin credit’ or no credit whatsoever. Most mortgage lenders offer these loans, although you’ll have to shop for a lender with flexible credit policies. The USDA loan is a no-down-payment mortgage for buyers in rural parts of the country and lower-density suburbs.

Sometimes when you have run into serious financial difficulties, the only way to get a loan is through a hard money lender. If your credit score is horrible, this is where a hard money lender would need to be utilized. With a lower credit score, you are always likely to pay more interest on the mortgage due to higher rates. Lower scores will push up the overall cost you pay throughout the loan and add to your monthly payment. Whenever you approach mortgage lenders, you might be surprised to learn that they don’t have a set minimum score requirement.

Comments

Post a Comment